Bandai Namco and the Business of Nostalgia

- Tiago Q T

- Feb 13, 2025

- 6 min read

If you grew up in Latin America during the early '90s, chances are you watched Saint Seiya - Toei Animation's adaptation of Masami Kurumada’s manga. While the series was well-known in Southern Europe, Japan, and Southeast Asia, it was an absolute cultural phenomenon in Latin America. It wasn't just the show on TV. Owning Saint Seiya-themed school supplies - a backpack, a pen, anything, really - was every child's reason to nag their parents. But the golden standard was owning an official Bandai-made character figure, though in a developing country, convincing your parents to buy one was far harder than getting a pirated pen.

These days, Saint Seiya character figures rarely sell for under $200, and some go for $1,000+ on the secondary market. Despite being a huge fan, I couldn't afford them back then. A couple of decades later, as a grown-up child with disposable income, I have been expanding my collection at a financially inadvisable pace.

After spending a few thousand dollars on these figures and somewhat fulfilling the childhood dream, I finally had a long overdue realisation: What exactly is Bandai?

Fun for All into the Future

Bandai started as a toy manufacturer in post-WWII Japan. By the 1960s, it was already producing anime figures, starting with Astro Boy - the series that laid the foundation for the anime industry (including the iconic large-eyed character design).

Another defining moment came in the 1980s when Bandai saved the Mobile Suit Gundam franchise by creating Gunpla - plastic model kits requiring assembly rather than offering a pre-built figure. The concept was a massive hit, revitalising the franchise and shaping the model kit industry.

With Saint Seiya, Bandai's involvement went even deeper; instead of simply licensing figures, it was part of the production committee, meaning the anime was designed from the start to drive merchandise sales, particularly character figures. Some armor designs differ from the manga to make them more visually appealing as collectibles.

In essence, Bandai built much of its business on leveraging popular anime IPs - nowadays also including franchises such as Dragon Ball, One Piece, and Naruto in its portfolio - to fuel demand for toys, figures, and other related merchandise.

However, the company we can invest in today isn't Bandai alone, but Bandai Namco Holdings Inc. (TSE:7832), which was born in 2005 from a merger between Bandai (toys, anime-related merchandise) and Namco (arcade & video game development).

Namco, another Japanese entertainment giant, is behind legendary games like Pac-Man, Galaxian, and Tekken. The merger thus combined anime-driven merchandising with gaming, forming a truly holistic entertainment conglomerate. Or, as they state as the group's purpose, "Fun for All into the Future".

Today, as shown in the image above, roughly 80% of Bandai Namco’s revenue still stems from the core businesses that shaped the 2005 merger. The Toys and Hobby division remains a dominant segment, still driven by Gunpla and action figures, along with capsule toys (Gashapon) and trading card games like the One Piece Card Game. Meanwhile, the Digital segment thrives on video games, with key titles including Elden Ring, Dark Souls, and Dragon Ball.

Fun and Profit

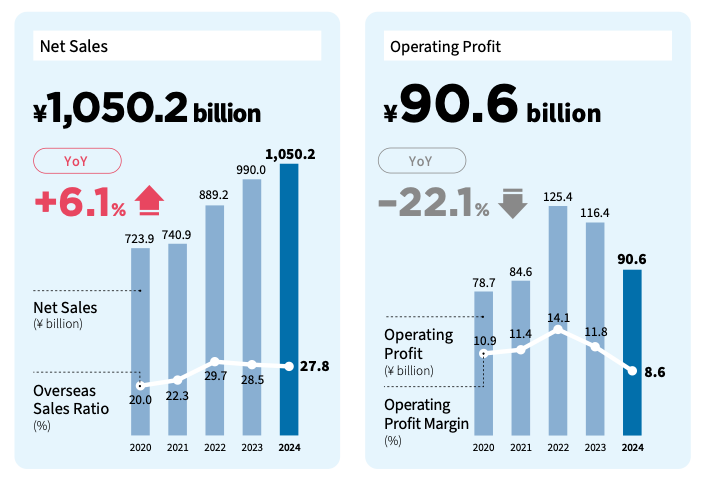

In FY 2024.03, Bandai Namco reported ¥1,050.2 billion in revenue - roughly $6.8 billion with today's FX. As the charts below illustrate, revenue has consistently grown over the past 5 years, with a CAGR of nearly 10%. And while operating profit looks less stellar in the plot below, it doesn't include the most recent numbers, where it reached ¥191.6 billion (on a ¥1.2 trillion revenue) TTM.

One interesting trend is the considerable rise in overseas sales. In 2020, international sales accounted for just 20% of total revenue, but by 2024, that share had climbed to 27.8%. The most striking jump came between 2021 and 2022, when overseas sales surged by ¥99 billion compared to just ¥49 billion within Japan. Wow! I knew I was overspending on my collection, but oh boy!

Another interesting trend appears when looking at revenue composition over time. We see that the Toys and Hobby unit has been the largest driver of growth in recent years. Since 2017, this segment has more than doubled, and Bandai Namco projects another 20% increase in the next 12 months. It overtook Digital as the largest contributor to revenue in 2021.

The impact of weebs?

So let's put together the above two key trends: growth in overseas sales and the expansion of Toys & Hobby. Here is a bit of educated guessing: weebs! Circa 2021/22, many of us were stuck at home due to the pandemic, with extra disposable income from savings on eating out, travel and other impossible-at-the-moment activities. Among the many hobbies that took off during that time, action figure collecting saw a surge.

It was also around that time that anime exploded into mainstream culture, with titles like Demon Slayer, Jujutsu Kaisen, and Attack on Titan appearing on global streaming platforms. Charlie Munger often spoke about Lollapalooza Effects (wow - bringing CM on a post about anime figures!). In essence, a Lollapalooza Effect occurs when multiple forces align in the same direction, amplifying each other's impact.

But the pandemic is long over, and the revenue is still climbing - so what gives?

Well, first, once you get into collecting, it's not exactly a hobby you just quit cold turkey. One figure leads to another, and before you know it, you're mentally justifying a ¥60,000 purchase on a single figure because "it completes this subset" (a "friend" told me). Within the Saint Seiya universe alone, there are dozens of characters, and each character may appear with several armors throughout the series.

Second, although people have returned to traveling, guess where they are going?

Japan just recorded a historic high in visitors in 2024, and I wouldn't be surprised if tourist spending habits have shifted. Instead of picking up cheap fridge magnets, more travelers are walking out of Akihabara with anime figures and model kits. While some of this is my speculation, Bandai Namco itself acknowledges this trend in one of its latest consolidated reports:

As for the Toys and Hobby Business, we continued to perform well amid growing popularity of Japanese IP in the global market [...]. Specifically, products for the mature fan base (adults) such as model kits of the Gundam series, and collectible figures continued to perform favorably [...]. In addition, card products such as trading card games of ONE PIECE and the DRAGON BALL series, capsule toys, confectionery products, and food products contributed to business performance [...].

Investing in Bandai Namco

Peter Lynch’s One Up On Wall Street famously suggests investing in companies you know and like. Well, I like Bandai Namco’s products, and now I know more about the company. Might as well give myself another excuse to buy more figures. After all, for every figure I buy, maybe $0.0000001 comes back to me as a dividend.

Of course, I also did look into the usual metrics—P/E, P/S, debt levels, cash reserves, etc. Platforms like TradingView or most broker dashboards provide these for free. In short, I liked what I saw: not expensive relative to revenue and earnings, very low debt, a pile of cash, etc.

But here’s the thing - the market is almost always right, so to me, there’s little point in overanalysing those numbers. Bringing it back to Lynch’s philosophy, if retail investors have an edge, it’s probably not in beating analysts at financial modeling but in noticing things they don’t - like being a collector and understanding the emotional pull of a company’s products firsthand.

So, a few days ago, I bought a few shares. Luckily enough, Bandai Namco’s latest earnings crushed expectations, and my first days as a shareholder have gone quite well.

As for the long term, even decades after first watching Saint Seiya, the franchise still resonates deeply with my childhood memories. And I’m far from alone - there’s an entire generation of anime fans now reaching the point in life where they can finally afford the things they once dreamed about as kids.

Having such a dedicated, lifelong fan base - combined with a product that taps into people's deep emotional connection to their past - speaks to a powerful investment theme that can't be neatly captured in an Excel spreadsheet: The Business of Nostalgia.

Comments